5 key considerations to position for successful retail of the future

The future of retail looks bright – at least from the viewpoint of consumers. For retailers, some tough challenges are lining up:

- The sustainability challenge and how to meet the purposeful shopper

- Enhancing the omnichannel strategy to meet a diversified audience and the proliferation of apps and touchpoints

- The monetization of customer data in a world of data privacy concerns

- A need to develop private brands to increase earnings

- And exploring the use of emerging technologies

Retail of the future is predictable

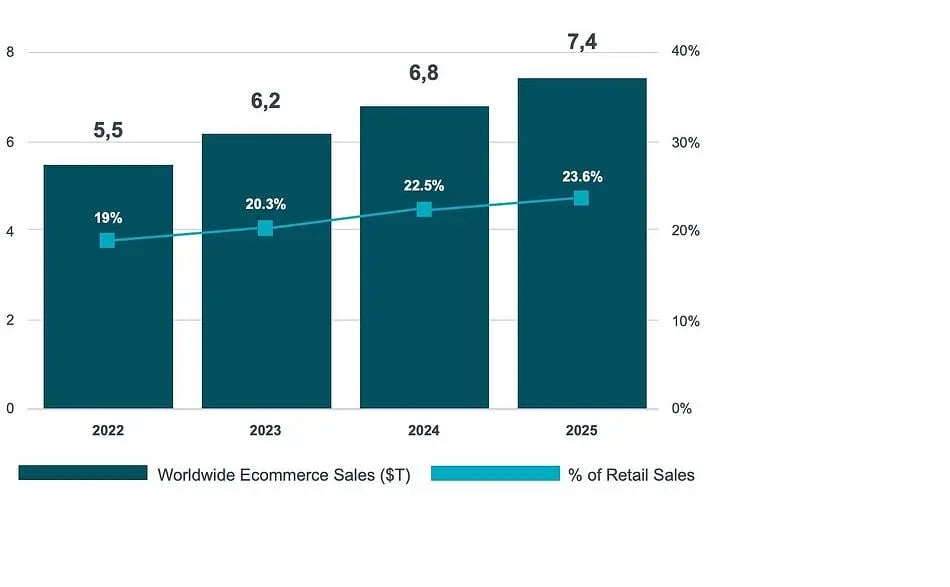

Retail looks a lot different than it did three years ago and in three years’ time, operational models, consumer touchpoints and the overall customer experience will evolve in new ways. Since 2019, consumers have tested and adopted more digital touchpoints in their purchase behavior. After a tumultuous time of brand and retail switching in 2020 consumers have now settled into more of a regular pattern and predictability of consumption. Their adoption in new digital habits and realized benefits of convenience and time savings catapulted ecommerce sales. The growth continues, albeit at a slower pace, and it is forecasted that ecommerce sales will grow by an additional $1.9T globally in the next three years. (Insider Intelligence, Global Ecommerce Forecast 2022, Feb. 2, 2022).

Ecommerce Growth Forecast

Global Ecommerce Forecast 2022, Insider Intelligence

Retail Ecommerce Sales Wordwide

$ Trillions and % of Retail Sales

The digital shift

Retailers have shown agility under pressure to address the changed habits from an ecommerce perspective and have quickly built technical capabilities to fulfil consumer needs. With all this growth, it is important to recognize that ecommerce retail sales accounts for less than 20% of total sales. Meanwhile, in-store has become more tech infused with more devices and data at the hands of employees and new technical shopping aids such as AR/VR solutions to digitally evaluate products pre-purchase. Therefore, in the future, retailers will be thinking more broadly about retail sales and ecommerce as part of an ecosystem influenced by digital interactions. Consumers have increased expectations about the purchase journey that has become more digital in the following examples: buy online–pick up in store, showroom in store and buy online or buy online and return in store and all the other various commerce combinations.

REPORT

Stibo Systems Recognized as a Leader in IDC MarketShape: Worldwide PIM Applications for Commerce 2024-2025 Vendor Assessment

Purposeful shopping

Beyond the digital shift, the other noticeable trend is that consumers have been more purposeful in their shopping from a societal perspective and sustainability point of view. Consumers have re-evaluated their purchase behaviors and increasingly have recognized that they can make a difference in the world not only by their actions but also with their buying choices. With this change in shopping perspective, consumers are asking more of retailers requiring retailers in the future to evaluate their business decisions and alignment to their values.

5 key areas to position for a successful future in retail

1. Setting and meeting sustainability goals

Sustainability has reached a whole new level of priority for retailers looking ahead to a post-Covid business environment. Scientists have identified that climate change has reached crisis levels. Interest and urgency about sustainability has grown from the consumer, community, regulatory, investment and supplier perspective for retailers. Retail is at the crossroads of commerce. Therefore, retailers are addressing environmental problems and participating in part of the climate change solution. Retailers’ solutions include establishing the more environmentally sustainable product offerings in the market, innovating in more efficient store operations and partnering with their supply chain partners to reduce emissions. These are some of the top opportunities for retailers.

However, developing and sourcing sustainable products can be risky for retailers and these items may be higher priced as well so there has been an ongoing question if consumers would pay the premium. Generally, the younger and more affluent the consumer, the more likely that consumers will pay more. Currently 60% of Gen Z, higher income shoppers are willing to pay more for sustainable products vs. only 49% among all demographics. (Source: Climate sustainability in retail: Who will pay?, McKinsey & Company, May 4, 2022).

This willingness to spend more has increased more than 10 percentage points overall in the last two years, reports McKinsey. Now several years into sustainability plans, most retailers have now integrated sustainable processes across their organization and established aggressive goals such as to be Carbon Net Zero by 2030. The investment community is starting to see the financial performance gap between sustainably focused companies and their peers. To ensure full understanding of ESG activities of companies there is a call for more standard adoption and transparency. (Source: The economic realities of ESG, PwC, 2021).

Looking toward retail of the future, expect more retailers to learn best practices from the leaders and establish their own sustainability strategies that best serve their customers, category and market. Better data, adoption of standards and increased collaboration are needed to work with data such as ingredient sourcing, product enrichment final goods development, efficient last mile delivery and finally to consumer post-purchase feedback.

2. Delivering customer experience personalized for omnichannel and beyond

The impact of influencers has waned in marketing. Customers are searching for information about products and services at their most important retailers and brands, and they want to be known and catered to by retailers. Retailers today are using consumption behavior and annual customer satisfaction surveys to better understand the consumer and potential customer experience gaps. As consumers gradually move away from social media and toward newer virtual and augmented realities, new challenges will arise in connecting to consumers to communicate in these communities and offer relevant and personalized offers. Furthermore, experience matters across all channels and consumers are not thinking about individual channels but the overall retail experience. A recent survey indicated this fact. 65% of consumers say that they are likely to spend more online with a brand if they have a positive offline experience. (Raydiant, State of Consumer Behavior 2022).

Retailers that are extremely focused on understanding their consumers are addressing the foundational challenge of a complete view of customer by bringing in the various touchpoints together to establish a 360-degree view. This 360-degree view ensures that the in-store associates, the digital concierges, the marketers, customer service agents and ecommerce team and digital communication platforms are using the most up to date data that have been shared by the consumer with consent. Retailers of the future will bring in new capabilities to appropriately capture more data about customer interactions, their preferences and develop more complete profiles that can be used to fuel predictive analytics. Use of advanced customer analytics and business rules will be used to improve relevant and timely communications wherever they are: in the store, online or in the various other digital realities such as the metaverse.

WHITE PAPER

Strategies for a Superior Omnichannel Experience

How to leverage your data to win

customer loyalty in retail.

3. Monetizing customer data

With all the ecommerce growth over the past twenty years there have been mistakes made along the way and one key one was marketers’ overuse of customer information and occasional disregard of privacy. Major social media sites and leading digital platforms and digital ecosystems have discontinued their capability to use cookies or allow for tracking of consumers as they browse the web. This was done in response to current and expected privacy regulations that have been enacted around the world. As a result of the lack of the ability to target consumers as precisely as in the past, there is a massive transition happening in digital advertising and billions of euros and dollars up for review as brands and manufacturers re-evaluate where to best spend money going forward.

The end of cookies in marketing has opened an enormous door for retail to fill digital marketing gaps. Retail media network (RMN) is essentially a digital advertising platform that allows manufacturers to invest in reaching retail customers through various tactics such as web pages, social presence, app pages through first-party data and other analytics. Most of the larger retailers in the world have evolved their shopper marketing programs to RMNs and have built the technical capabilities to become more digitally enabled to reach and communicate to consumers more precisely.

In the future of retail over the next three years, we will see the phase of trial and testing among key players become more mature with more consistent outcomes and ROI to become key differentiators. If major retailers are not readying themselves or have launched their own media networks, you are likely missing out on opportunities to communicate with consumers to drive traffic and conversion and the promotional revenue dollars as well.

Aligning business decisions to Corporate Social Responsibility

Why are you doing this? How are you making a difference? What is your reason for being, besides making money? There is no engine or vehicle like business to make a difference. - Walter Robb, former Co-CEO, Whole Foods

4. Retailers invest in private brand products and services

We have moved past the high growth phase in the past few years across many retail channels that were driven by changing behaviors and more plentiful money due to various stimuli. Retailers are now facing a harder road to true growth due to a combination of factors including supply chain uncertainty, lower consumption and slowing population growth. The biggest economic factor in the last year has been inflation. Inflation is at the highest level in decades in many regions around the world with an expected rate of 7.7% in 2022. This is 5 pts higher than the average between 2010-2019. (Source: Inflation Expected to Stay High Worldwide for the Next Few Years, IFO Institute, 2022).

Astute retailers are already looking at growth beyond national branded product assortment or new products. With all the food, beverage and other consumer good cost increases, consumers naturally moderate their choices to more affordable brands. As a result, retailers are heavily investing in private brands within current categories and innovating in new categories and even into new services. According to the IFO Institute for Economic Research, global inflation will be higher than average for the next three years. As a result, private brand growth is expected as 91% of retailers expect to increase investment moderately or significantly in private brands. (Source: How Private Labels Can Own 2022, Winsight Grocery Business, 2021).

Successful retailers in the future will understand where their consumers will splurge on premium and where they will look to cut costs and proactively manage their margin based on this understanding.

5. Enhanced digital capabilities to enable teams and analytics

Most retailers have undergone some digital transformation in the past five years and certainly the pandemic has driven more ecommerce and supply chain capabilities. Additionally, there is more sources of invaluable data with greater variety and increased volume. It is important that your technology and processes are built to absorb and make sense of this information.

- How has your foundational business data evolved in the last few years?

- Is there a measurable difference in quality, completeness and is your data fit for purpose to feed your analytical tools?

- How are you evolving your business model and automating workflows help teams make timely business decisions, and enable your data science teams to drive new insights?

- How are you using AI to reduce the rudimentary data maintenance and organization tasks and reduce the workload of your data analysts, marketing professionals and leaders?

The next few years will be a continuance of the digitalization and adoption of AI of retail organizations. Considering the size of the organizations, the large store count and multiple digital internal and consumer facing sites, it is a challenging task because the data needs across teams is incredibly large and can be overwhelming. All retailers will be reviewing these innovative technologies, and most will adopt to use some or all of these as it makes sense to the business and resonates with their customers. In the retail of the future, many will be working toward a more unified data model and using data governance and more orchestrated data sharing to ensure that they can continue to make informed analytically driven decisions.

A successful retail future demands better data

Consider the combination of location, customer, product data, supplier data and other business data that are used hourly within a retail organization. There is no lack of data, but there remains an opportunity for retailers to increase the value of the data to integrate this data to deliver the resulting insights and actions. The opportunity is to harvest this data and use the insights to learn faster, test new ideas and continuously improve in execution and personalization appeal to their consumers. Being ready for the future requires a solid foundation of unified business data. This information needs to be trustworthy and transparent to provide the information to the teams to learn about their market and their customers.

The journey toward better data management can start here:

EXPLORE

Master Data Management for Retailers