To make money from data requires insightful data

In today's data-driven business environment, companies are constantly looking for ways to maximize the value of their data. One such approach is data monetization, which involves transforming data into a revenue stream.

In this article, we'll explore some data monetization examples and use cases and explain how multidomain master data management can help provide data insights that support these initiatives.

With the right approach to data management, businesses can unlock the full potential of their data assets and gain a competitive edge in their industry.

What is data monetization?

Data monetization is generally understood as the “process of using data to obtain quantifiable economic benefit” (Gartner Glossary, Data Monetization). Three typical ways to achieve this, include:

- Using data to make better decisions and thus enhance your business performance

- Sharing data with business partners for mutual benefit

- Selling data as a product or service

Whichever way you choose, data monetization gets more profitable if you can provide context to the data and make it insightful.

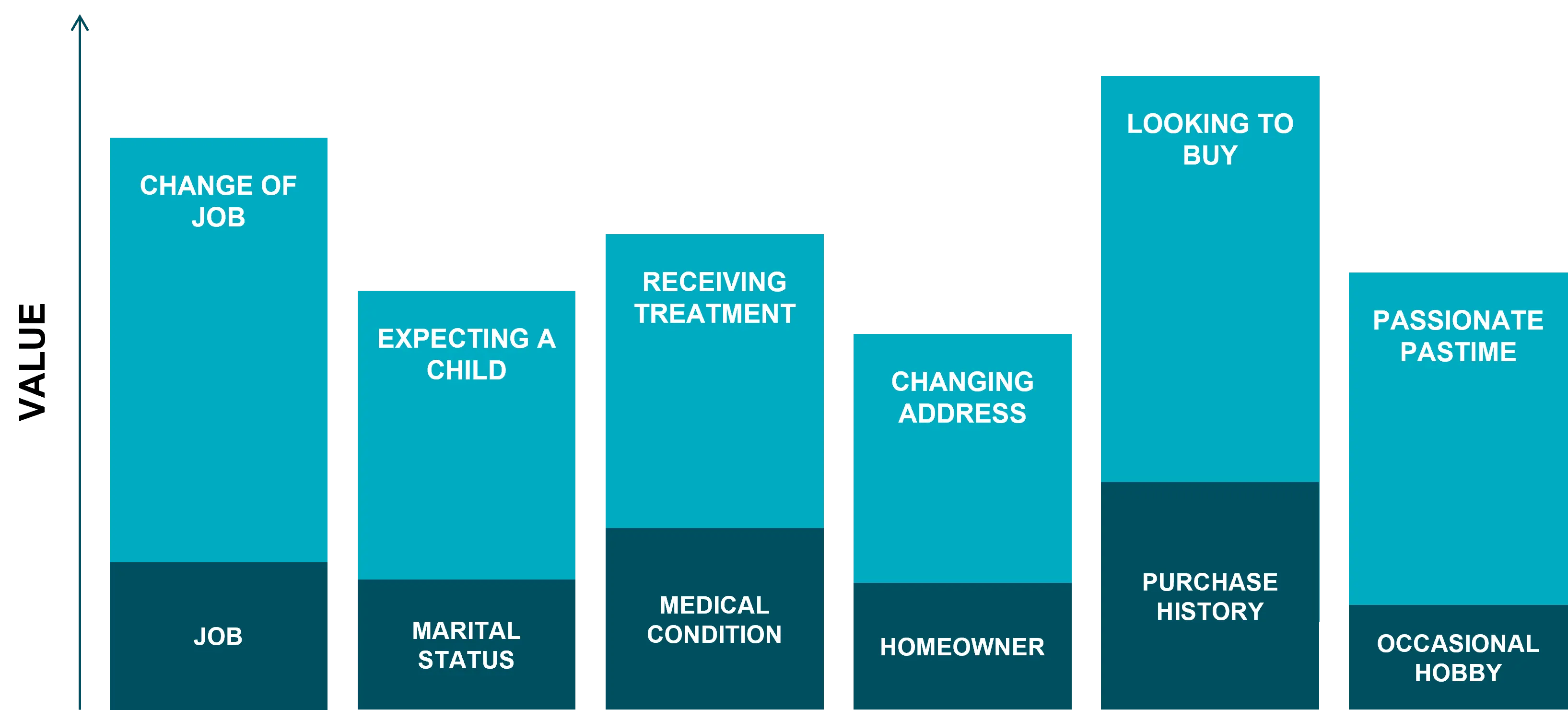

The more insight your data provides, the more valuable it is. Take as an example a person about whom you know the job title. That is basic master data. Adding to that information the insight that the person has recently changed jobs, can open new business opportunities or guide your marketing efforts to be more targeted.

Perhaps the job change entails a salary increase, a change of location, new business connections, etc.

What is multidomain master data management?

In short, master data management can help build insights by adding context to information and creating 360° views of customers and businesses.

Multidomain master data management is characterized by common governance of different data domains, thus revealing enhanced insights at the intersections of those domains.

This approach supports data analytics and business intelligence efforts.

Why monetize data?

Organizations should consider data monetization as a potential revenue stream for several reasons:

-

Generate new revenue streams: Monetizing data can open up new revenue streams for organizations, particularly those in industries where data is a valuable commodity, such as finance, healthcare or marketing.

-

Enhance business insights: Your organization can enhance the profitability of existing operations by leveraging big data and data analytics to gain deeper insights into customer behavior and market trends. This can enable you to develop new products and services that inform future business strategies and improve decision-making.

-

Improve customer experience: Monetizing data can help organizations deliver more personalized and relevant experiences to customers, which can improve customer loyalty and satisfaction.

-

Competitive advantage: Data is becoming an increasingly valuable asset and organizations that can monetize it effectively can gain a competitive advantage in their industry.

-

Better risk management: Monetizing data can help organizations identify and mitigate potential risks and compliance issues by providing a more comprehensive view of their business operations and performance.

Overall, data monetization can provide organizations with significant benefits, from generating new revenue streams to gaining deeper insights and improving customer experience.

However, it is important for organizations to approach data monetization carefully, ensuring that they comply with legal and ethical guidelines and protect the privacy and security of their customers' data.

GARTNER REPORT

How Financial Services Institutions Deliver a Better CX

Data monetization in numbers

Data monetization is not a new idea. But the growing number of data marketplaces and exchanges is making it easier to achieve.

According to Gartner: "By 2022, 35% of large organizations will be either sellers or buyers of data via formal online data marketplaces."

Economists like data. It is a non-depleting asset, in other words, you can sell or use data as many times as you like and it never runs out. Unlike oil.

Infonomics is the discipline that adds an economic (i.e., monetary) value to data. And a revolution is taking place within many industries to collect and analyze more data, to make more money on existing monetization initiatives and create new revenue models.

By 2022, 30% of leading organizations will formally adopt infonomics practices and value their information assets, maintaining a balance sheet for internal purposes.

Source: Gartner

Build a Data-Driven Enterprise, 2018

"By 2022, 30% of leading organizations will formally adopt infonomics practices and value their information assets, maintaining a balance sheet for internal purposes."

- Gartner, Build a Data-Driven Enterprise, 2018

Your data has value — learn how to increase it

Some estimates put an individual’s basic demographic information (location, age, gender, etc.) at about $0.0005 per person. That’s $1 for every 2000 individuals. Not much.

But adding to that basic information new layers of data that describe what that person has bought or what they are currently interested in buying could increase value. As does the ability to discern if the individual is an influencer or has a good credit rating.

Beyond the type of data, its overall value is significantly impacted by its veracity, coherence, insightfulness, legality, adherence to ethics and availability.

This is where multidomain master data management becomes a key success factor as part of any monetization program. Multidomain master data management helps to ensure that business critical data can be safely and lucratively shared.

Data monetization examples

Hundreds of companies that you may or may not have heard of are in the pure, data-collection and monetization business. Experian, Equifax, Acxiom and WPP for example, provide data services for marketing and risk management.

Other companies have data monetization as part of their business, such as Google, telecom network providers and retailers.

Examples of data monetization

Data monetization in retail

Retailers use their loyalty programs to know what you buy in their stores so that the data may be shared with supplier partners for developing more effective merchandising strategies. This shared data enhances partnerships and mutual benefits.

Data monetization in banking

Banks can infer what you buy and know from where you buy it, making their data highly valuable for industry analytics and marketing specialists. This can support real-time marketing and customer engagement strategies.

Data monetization in manufacturing

Manufacturing creates a large amount of data that can be better leveraged to improve business efficiency, but also has the potential to be transformed into data products such as R&D information, customer service and support data as well as supply chain maintenance information. These data products can then be shared with data providers or other industry partners for increased collaboration.

Some companies have driven new business models from their data. Allstate insurance has a subsidiary called Aris that is sharing vehicle telematics information to advertising companies and other types of businesses looking to implement new types of business models based on location data.

What types and sources of data can be monetized?

Some data sources are obvious targets, such as those representing current customers and their transaction trends.

Value also abounds in historical information and dark data sources. These sources might not be actively used to run the business on a day-to-day basis, but they might find a new lease of life in monetization efforts.

Consider historical records of insurance claims being shared with partners who have AI engines looking for patterns from which it can learn to automate underwriting, predict future trends, or even identify new business opportunities.

Guarantees of accuracy can increase data value

Certainly, the type of data being shared or sold will have inherent value. But its accuracy, timeliness, coherence, richness and insightfulness will also play an important role in determining this value.

For example, First American’s property data description (access to which is commercialized) adds, “…our data is different because we have enhanced data collection and … validation through multiple sources”.

Sharing data with your partners and suppliers can be mutually beneficial

Many companies collect customer information internally in order to understand how and when to propose more relevant products and services to their customers. However, sharing this data externally, with suppliers and business partners, can be mutually beneficial.

The retailer Kroger provides CPG companies with data about their customers so that they can target them on Kroger's website.

Collaborating in a two-way data sharing initiative could help support improvements in merchandising and demand planning.

For example, consider a retailer who learns from their supplier that sales of product A increase when it is placed in proximity to product B.

Financial services companies already share transactional data, albeit, predominantly anonymized and aggregated. In other words, they are not allowed to share your personal data.

The customer data they do share typically reflects trends from a wider customer segment.

For example, they could get commissions from merchants if they promote their products and services rather than just taking the standard merchant service charge.

Data value increase: The more specific information is to an individual and the more context it can get, the more valuable it becomes.

Whatever the industry, opportunities abound for those who want to monetize or collaborate with their most valuable data.

How does multidomain master data management increase the value and security of your data?

1. Increasing value of data

Good data is more valuable than bad data. By being able to describe a process by which you have ensured your data is accurate and coherent (even when anonymized), you increase the value of the data itself.

Multidomain data is insightful. Producing data that not only describes single-dimensional viewpoints, but joins data domains together and describes their inter-connectivity (also referred to as zones of insight), provides additional value.

This is especially important when using a multidomain master data management solution that can demonstrate governance processes which ensure this data is being well-behaved and managed.

2. Safeguarding brand reputation

Governed data is fit for purpose. Multidomain master data management enables you to demonstrate that the business has managed a process by which key business facts (master data in particular) are ethically administered.

Unified data is secure. By having a centralized point of governance to safeguard the data source, those who collaborate on the data production and stewardship can include legal and ethical controls. This minimizes the risk of the data being misused or becoming a threat to your brand.

Consent and privacy are managed. Multidomain master data management allows any form of consent and privacy related to a data sharing initiative to be recorded alongside the data and processes to which it is associated.

Multidomain master data management is especially relevant to support the layers of complexity that may arise from managing consent for data describing specific inter-domain relationships, such as sharing purchase history against certain categories of products.

3. Managing the economic value of data

Defining and monitoring KPIs for economic value. Multidomain master data management can help establish the link between master data sets and the indicators by which their data policy standards must perform (for example, quality, timeliness, completeness, etc.) in order to maintain master data at target economic values.

Organizing data for target revenue streams. Multidomain master data management manages a structured process by which data may be organized and vetted for suitability and compliance prior to sharing with customers and business partners.

Supporting the master data management project’s ROI. Multidomain master data management can provide metrics on data performance that will support a balance sheet.

How to prepare and create a data monetization strategy?

Creating a data monetization strategy requires careful planning and consideration. Here are some key steps to follow to prepare and create a data monetization strategy:

1. Identify potential data sources

The first step is to identify the sources of data within the organization that could be monetized. This may include customer data, sales data, operational data and more.

2. Define the target audience

Determine who the target audience for the monetized data will be. This may include customers, partners or third-party data buyers.

3. Evaluate data quality

Evaluate the quality of the data to be monetized, including its accuracy, completeness and consistency.

4. Determine data value

Determine the value of the data to potential buyers, considering factors such as its uniqueness, relevance and timeliness.

5. Identify data monetization opportunities

Identify potential monetization opportunities, such as licensing data, creating data products or providing data services.

6. Establish pricing

Set pricing for the monetized data based on factors such as its value, market demand and competitive landscape.

7. Establish data governance policies

Establish data governance policies that ensure the privacy and security of the data, as well as compliance with legal and ethical guidelines.

8. Develop a marketing and sales plan

Develop a marketing and sales plan for the monetized data, including promotional activities, sales channels and customer support.

9. Implement and monitor

Implement the data monetization strategy and monitor its performance, making adjustments as needed to optimize revenue and ensure compliance.

Creating a successful data monetization strategy requires a multidisciplinary approach, involving stakeholders from IT, marketing, legal and other relevant areas.

By following these steps and collaborating across departments, organizations can create a data monetization strategy that maximizes the value of their data and generates new revenue streams.

Enhance data monetization with valuable data

Treating information as a corporate asset means attaching an economic value to it. Whereas all data has some intrinsic value, the value of data held within a multidomain master data management solution can often be quantified.

Whether you intend to sell your data, share it with business partners for mutual benefit, or extract its value to enhance your own offerings or operations, the ability to demonstrate governance over its transparency enhances its worth.

EXPLORE

Multidomain Master Data Management